Special depreciation allowance calculator

Dearness allowance medical and transportation allowance gratuity benefits annuity benefits and any special allowance. See the screenshot below.

Small Business Income Statement Template Unique 27 Free In E Statement Examples Templates Single Income Statement Statement Template Business Template

NW IR-6526 Washington DC 20224.

. Car Depreciation Calculator. An income tax calculator is a simple tool that you can use to calculate tax online. The allowance applies only for the first year you place the property in service.

Salary Formula Example 3. Managed Fund MFM Techinvest Special Situations. Many items over 200 are depreciated over a number of years as Assets.

A part of this gross. We welcome your comments about this publication and your suggestions for future editions. Also see the instructions for Form 4562 line 14.

I pick Appliances carpets and furniture then I can get to the screen that allows me to pick bonus depreciation but Appliances carpets and furniture appears to be for 5 year assets not 275 year assets. Use this depreciation calculator to forecast the value loss for a new or used Mercedes-Benz. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200 if the special depreciation allowance applies or 10200 if the special depreciation allowance does not apply.

Clicked continue and TurboTax calculated 45 in depreciation. You can take a special depreciation allowance to recover part of the cost of qualified property defined next placed in service during the tax year. Ideal for stocks cryptocurrency home refinancing and more.

The special depreciation allowance has not and will not be claimed on the car The special depreciation allowance is part of the 179 deduction which is a limit on the amount you can claim. Starting September 28th 2017 the Special Depreciation Allowance has changed to 100 It is an automatic thing. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Special surrender value Basic sum assured X Number of premiums paid number of premiums payable accrued bonuses X applicable surrender value factor. If you have paid three full years premiums you can surrender the plan. This benefit is calculated to be higher of the Guaranteed Surrender Value GSV or the Special Surrender Value SSV.

Depreciation limits on business vehicles. Jeevan Saral calculator surrender benefit. Ayuda disponible en Español.

Conveyance Allowance allowed for Handicapped people. Use a Tax Depreciation Calculator. Form W-4 Employees Withholding Allowance Certificate.

Rental Real Estate Loss Allowance. The Special Depreciation Allowance gives you 50 of that deduction in the first year then the other 50 is depreciated as usual. I never got a screen with an option to pick bonus depreciation.

In that case you should use an investment property depreciation calculator to get at least a general idea about the tax deductions you can claim in your tax return. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Learn how to Calculate Income Tax Online for FY 2021-22 AY 2022-23 with IndiaFirst Life Income Tax Calculator.

See chapter 3 of Pub. Depreciation is an amount deducted to recover the cost or other basis of a trade or business asset. For 2020 some properties used in connection with residential real property activities may qualify for a special depreciation allowance.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Suppose you need to calculate the depreciation of your property. Many expenses can be deducted in the year you spend the money but depreciation is different.

This allowance is figured before you figure your regular depreciation deduction. This calculator figures monthly motorcycle loan payments. This lets us find the most appropriate writer for any type of assignment.

Special rules provide for tax-favored withdrawals and repayments to certain retirement plans including IRAs for taxpayers who suffered economic losses because of certain major disasters. Here the gross salary 660000. The special surrender value will depend on a number of premium instalments paid by you policy term and the bonus accrued if any.

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. The deduction will be Income tax and provident fund. Soon Be Tax Free Government consulting to provide tax free advice for pension planning by creating a new Pensions Advice Allowance worth 500.

Special surrender value is calculated as. Get 247 customer support help when you place a homework help service order with us. To help you see current market conditions and find a local lender current current Boydton motorcycle loan rates and personal loan rates personal loan rates are published below the calculator.

The first-year limit on depreciation special depreciation allowance and section 179 deduction for vehicles acquired after September 27 2017 and placed in service during 2021 increases to 18200. In 2021 this is 18200 if the asset was placed into service during the year. The amount you can deduct depends on the propertys.

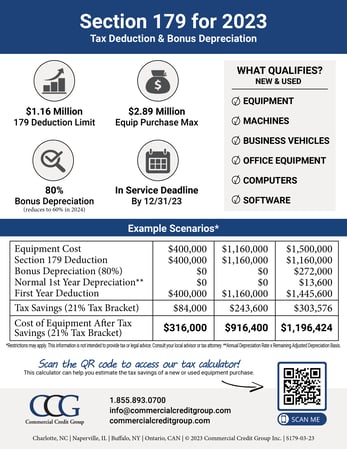

Qualified Asset must be set to Yes see below. What is a Section 179 deduction. Here the basic salary will be calculated as follows.

The second monthly payment budget calculator shows how expensive of a motorcycle you can buy given. Managed Fund R. We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time.

On surrender the policy pays the surrender benefit. From 8995-A Sch D Special Rules for Patrons of Agricultural or Horticultural Cooperatives. A change from claiming a 50 special depreciation allowance to claiming a 100 special depreciation allowance for qualified property acquired and placed in service by you after September 27 2017 if you did not make the election under section 168k10 to claim a 50 special depreciation allowance.

In the case of individuals who are offered a special allowance the employees have an option to substitute INR 1600 from the special conveyance allowance as conveyance reimbursement claiming tax exemption on it. If you elect not to claim a special depreciation allowance for a vehicle placed in service in 2021 the amount increases to 10200. If the special allowance does not apply the limit is 10200.

There is no specific calculation or formula for calculating conveyance allowance. But you can deduct or subtract your rental expensesthe money you spent in your role as the person renting out the propertyfrom that rental income reducing your tax obligation. Basic Salary Dearness Allowance HRA Allowance conveyance allowance entertainment allowance medical insurance.

A federal tax deduction of up to 25000 that is available to non-real estate professionals who own at least a 10 interest in a rental property that they. When you rent property to others you must report the rent as income on your taxes. What is MACRS and MACRS convention.

Special Allowance - calculated. If at step c. So the net salary comes to around 552400.

Per IRS Publication 946 - IRSgov How To Depreciate Property Section 179 Deduction Special Depreciation Allowance MACRS Listed it would generally be 15-year property. Therefore according to the Australian tax law you can claim tax deductions on. Schedule LEP Request for Change in Language Preference.

Bonus Depreciation Key To Incentivizing Aircraft Transactions Nbaa National Business Aviation Association

How To Calculate Depreciation Youtube

Calculating Opportunity Zone Benefits To Compare Investment Risk And Return Baker Tilly

Macrs Depreciation Calculator Macrs Tables And How To Use

Macrs Depreciation Calculator Straight Line Double Declining

What You Need To Know About Bonus Depreciation United Leasing Finance

Appliance Depreciation Calculator

Section 179 Calculator Ccg

Macrs Depreciation Calculator Straight Line Double Declining

Free Macrs Depreciation Calculator For Excel

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Learning Centers Tax Deductions Excel

Macrs Depreciation Calculator Irs Publication 946

Tax Law Changes 2021 Loss Limitation Rules Becker

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

Macrs Depreciation Calculator Based On Irs Publication 946

Section 179 Calculator Ccg

Macrs Depreciation Calculator Irs Publication 946